LNP – Business Policy rates to hold steady amidst sweeping measures to insulate economy: First Capital

First Capital Research believes that the Central Bank of Sri Lanka (CBSL) will maintain same policy stance in its monetary policy review, but given the concerns around economic growth, the research arm also supposes that there is a probability – to a lesser extent – that CBSL is likely to further ease its policy rates.

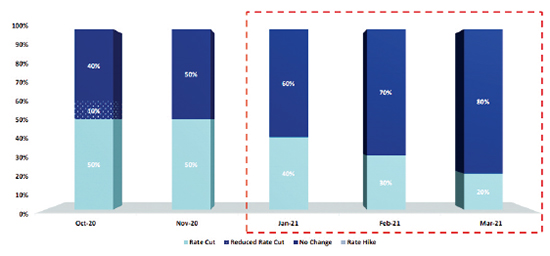

” The CBSL either can choose to hold policy rates steady or cut by a 25bps or 50bps while, hike is off the table due to the lackluster economic growth. We believe that there is a 60% probability to hold rates due to the considerable improvement in high frequency indicators and with fiscal and monetary measures implemented so far. However, there is a 20% probability each for 25bps and 50bps rate cut to support economic growth,” First Capital Research said in its latest report.

At the previous policy meeting held on November 2020, CBSL maintained its monetary policy stance, emphasizing the fact that overall market lending rates have witnessed a reduction during 2020 and there is a need for a continued downward adjustment in lending rates to boost economic growth. Moreover, introduction of maximum interest rates on mortgage- backed housing loans is expected to provide additional stimulus to the economy.

The next CBSL’s monetary policy review is scheduled to be announced on 19th January 2021 at 07.30 am.

The research arm further stated that excess liquidity prevailing in the domestic market requires no change in current policy stance.

“As a response to the measures taken by the Government, market liquidity increased to an elevated level while recording a three-year high on 1 January 2021 amounting to Rs. 266.5 billion. Accordingly, this excess liquidity in the system is expected to retain market interest rates at single digit levels while inducing further credit expansion. This inquires the need of further policy easing at the upcoming review,” it said.

It further stated that there is gradual rebound in private credit to power economic growth.

“Private sector credit increased by LKR 41.0Bn in Nov 2020 recording a growth for the fourth consecutive month indicating a revival in gross loan disbursements up to pre-pandemic levels in Dec 2019. The continuous uptrend in private sector credit till Nov 2020 reflects that both businesses and individuals are accelerating their economic activities to make up for the lost opportunities during lockdowns in the first wave of COVID, which could power decent growth in 4Q2020 and onwards,”

In response to previous monetary easing measures implemented by CBSL, (including the lending caps) to bring down costs of borrowing of businesses and households, both market deposit and lending rates adjusted notably so far during 2020.

First Capital Research believes these measures will enable to maintain market interest rates at stable levels in 2021 while playing its aiding role amidst the pandemic driven economic contraction.

Meanwhile, the research arm estimates that Sri Lanka’s GDP would see its steepest contraction in history of -5.8% in 2020 and to see a gradual recovery of 2.8% in 2021.

“The current government’s key drive is the development oriented economic growth which was spelled out through the Budget 2021 and is in the process of changing gears of the economy from a “recovery phase to an expansion phase. Accordingly, Government plans to reach 6% and above GDP growth during the next 5 years commencing from 2021. As we believe a development oriented budget coupled with low interest rate environment can support the Govt.’s medium-term goals. Therefore, the need to accelerate the GDP growth can be considered as a major factor favouring further policy easing at the upcoming review,” it said.

“Government is more focused on domestic funding to finance the budget deficit. This is reflected by the improved domestic to foreign debt ratio to 55:45 by end Sep 2020 from the previous 51:49 as at end of 2019. In the midst of limited access to the international financial markets, Government opt to rely more on domestic borrowings to finance the budget deficit and hence easing rates at the upcoming policy meeting results in reduced funding cost favouring the government,” it added.